China’s eCommerce market is an undeniable force, accounting for over 50% of global eCommerce transactions and generating a projected $1.469 trillion in revenue by year-end 2024. This dominance is expected to grow further, with forecasts suggesting the market will reach a whopping $2.361 trillion in the next five years.

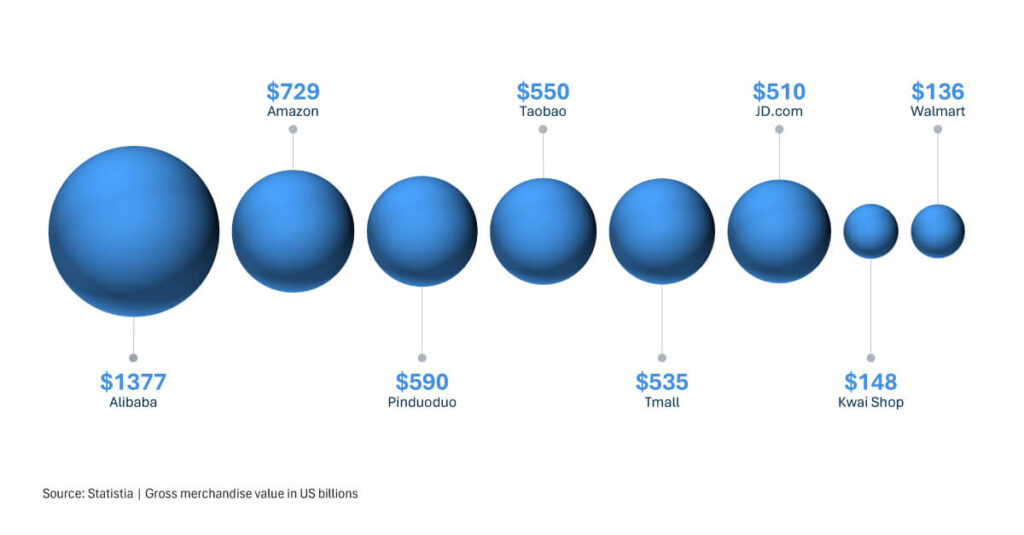

For Western brands, understanding China's eCommerce ecosystem requires a fundamental shift in perspective. While Amazon dominates American and European markets, China's digital commerce landscape is led by domestic platforms:

These platforms represent entirely different business models, consumer expectations, and operational requirements.

The scale of China's eCommerce adoption is staggering. User penetration is projected to rise from 78.8% in 2024 to 97.4% by 2029, representing unprecedented market reach. This growth represents evolving consumer behaviors, expectations and challenges that brands must understand to succeed.

Many brands are surprised to discover they already have a significant presence on China's eCommerce marketplaces—whether they've actively entered the market or not. This unofficial presence often comes through:

This unauthorized presence can either be a steppingstone to market success or a threat to brand value, depending on how it's managed.

In addition to the massive commercial opportunity that the market presents, operating in China's eCommerce space presents distinct challenges:

Digital channel control in China’s market requires more than just translating your existing eCommerce strategy. It demands a comprehensive, often global approach.

While the opportunity in China's eCommerce market is clear, brands must develop clear strategies for:

Ready to dive deeper into mastering China's eCommerce market? Download our white paper eControl China: Control & Grow Your Brand in the World's Largest eCommerce Market for detailed insights and actionable strategies.

Stay tuned for our next post in this series, where we’ll explore different market entry strategies and how to choose the right strategies and approach for your brand.